Rules for selling beer for individual entrepreneurs. Is the pavilion a stationary point or not? Is it possible to sell beer?

7613 lawyers are waiting for you

Do I have the right to sell beer with an area of 42 square meters in a stationary premises from January 1, 2013? Do I need to open an LLC?

Hello! Please tell me! I have an individual entrepreneur, the store is located on the 1st floor of a five-story building. The area of which is 42 square meters, with the release of a new law on the sale of beer from January 1, 2013. Should I sell beer with this area or do I need an area with more than 50 square meters? What should we do and what should we do? Since no one warned us about this! Does this mean they will confiscate our beer or give us time to sell it? Do you need a CCT? I work on UTII.

Lawyers' answers

Aliev Samir Nuritdinovich(01/08/2013 at 20:48:14)

This is the responsibility that awaits you Article 14.16. Code of Administrative Offenses Violation of the rules for the sale of ethyl alcohol, alcoholic and alcohol-containing products, as well as beer and drinks made on its basis

(as amended on December 5, 2005 N 156-FZ) (see text in the previous edition) 1. Retail sale of ethyl alcohol, including ethyl drinking alcohol (except for sales in the Far North and equivalent areas), alcohol-containing products under pharmacopoeial articles (with the exception of products sold through a pharmacy chain) or alcohol-containing flavoring biologically active flavoring additives or wine materials - shall entail the imposition of an administrative fine on officials in the amount of four thousand to five thousand rubles with confiscation of ethyl alcohol and alcohol-containing products; for - from forty thousand to fifty thousand rubles with confiscation of ethyl alcohol and alcohol-containing products.

Semyanov Marat Alexandrovich(01/08/2013 at 21:43:34)

Dear Elena, you do not face administrative liability, because the area of the premises is not regulated for the sale of beer. You can sell beer and beer drinks on behalf of an individual entrepreneur or organization, whichever is more profitable for you.

When carrying out activities to sell beer, I recommend that you familiarize yourself with the Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products and on limiting consumption (drinking) alcoholic products", which contains all the necessary information, restrictions and regulations.

Tsukanov Roman Viktorovich(01/09/2013 at 01:03:40)

Clause 6 of Article 16 of Federal Law No. 171-FZ "On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products" establishes that organizations and individual entrepreneurs carrying out retail sales beer and beer drinks, must have stationary retail facilities and warehouse premises for such purposes in ownership, economic management, operational management or lease (the requirement does not apply until 01/01/2013 in relation to beer and drinks made on the basis of beer containing ethyl alcohol 5 percent or less of the volume of finished products), as well as cash register equipment, unless otherwise provided by federal law. At the same time, the requirements for minimum room area(50 sq.m. - for urban settlements and 25 sq.m. - for rural settlements), as well as minimum lease term(one year or more), don't touch sales by individual entrepreneurs and organizations of beer and beer drinks. In addition, these requirements do not apply for retail sale of beer and beer drinks carried out by organizations and individual entrepreneurs when they provide services Catering

. Requirements for stationary retail facilities and warehouse premises are established by the authorized Government Russian Federation federal executive body.

About requirements for the availability of cash register equipment it should be noted that UTII payers, has the right to choose between the use of cash register equipment when making cash payments and issuing, at the request of buyers (clients), a document (sales receipt, receipt or other document confirming acceptance Money for the corresponding product (work, service)). The Federal Tax Service of Russia informed about this in its letter dated August 17, 2011 No. AS-4-2/13461@.

From January 1, 2013, any beer, regardless of strength, will be allowed to be sold exclusively through stationary facilities.

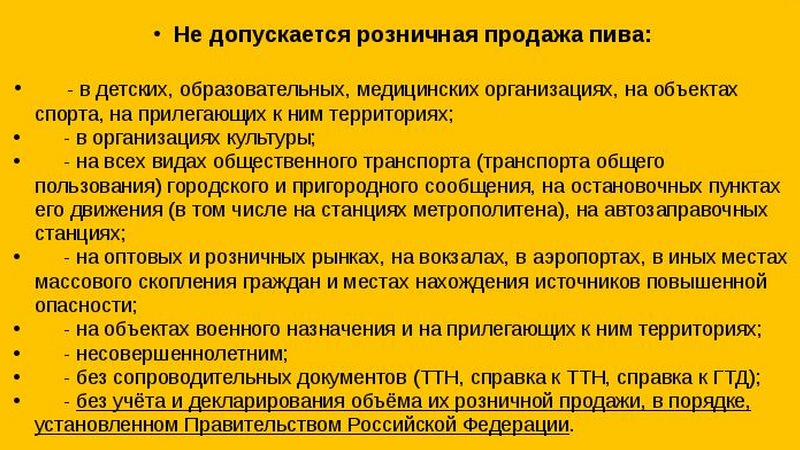

In addition, there is a list of places where you cannot sell any alcoholic beverages, including beer. These are children's, educational, medical organizations, sports facilities, as well as adjacent territories. This also includes wholesale and retail markets, train stations, airports and other places of large gatherings of citizens and sources of increased danger. Also subject to the ban are military installations, adjacent territories, all types of public transport, stops, gas stations and cultural organizations. This list is given in paragraph 2 of Article 16 of Law No. 171-FZ and is valid from July 22, 2011.

As for the area, there are no restrictions on the area of a retail facility for the sale of beer. In other words, if a company or entrepreneur is exclusively engaged in beer trading, they can use any store, even the smallest one.

But if, in addition to beer, there are other alcoholic drinks on the counter, from July 2012 you will have to comply with certain conditions. So, in the city, the total area of the store and warehouse in which such drinks are sold must be at least 50 square meters, in rural areas - at least 25 square meters. From July 22, 2011 to December 31, 2012 inclusive, beer with an alcohol content of no more than 5 percent can be sold at retail around the clock. Beer with an alcohol content exceeding 5 percent cannot be sold from 11 p.m. to 8 a.m. local time.

From January 1, 2013, the retail sale of any beer, including low-alcohol beer, will be prohibited between 11:00 p.m. and 8:00 a.m. (Clause 5, Article 16 of Law No. 171-FZ).

In general, from July 22, 2011 to December 31, 2012 inclusive, cash register equipment is not needed for retail trade in beer with an alcohol content of 5 percent or less. Sellers of beer whose strength exceeds 5 percent are required to use CCP. From January 1, 2013, for the retail sale of any beer, regardless of its strength, cash registers will be required (Clause 6, Article 16 of Law No. 171-FZ).

An exception is provided for single tax payers on imputed income. They have the right to choose: either use cash registers, or issue, at the request of buyers, documents confirming the receipt of money (clause 2.1 of article 2 of the Federal Law of May 22, 2003 No. 54-FZ).

Thus, if you are a “impossible” person, then you can do without a cash register. This provision is enshrined in a letter from the Ministry of Finance of Russia in letter dated 08.17.11 No. AS-4-2/13461@. Good luck.

Hello to all alarmists!

Right this morning, my inbox is flooded with letters, people are asking in the comments on the blog, what should I do now? After all, the Ministry of Finance proposed to ban individual entrepreneurs from selling beer from July 1, 2017! Ahh, the plaster is removed, the diamonds are taken out, everything is gone! Nothing is missing, gentlemen. Relax! I think such a bill will never become law and here's why.

How many such initiatives have our narrow-minded deputies already had? Hundreds! And how many of them have passed? Units! In the accompanying note, the Ministry of Finance argues for its bill by the fact that individual entrepreneurs do not fully declare the volume of retail beer sales. As an illustration, data is provided that separate Breweries declared for 2015 several times less volume of beer than what was sold at retail.

The key word here is separate. How many of these breweries are there? One? Two? What are their names? Where are they located? Unfortunately, the Ministry of Finance does not provide such data, i.e. no evidence of the guilt of these very individuals. Perhaps our deputies decided to take an example from US representatives like Kirby or the notorious Psaki, who from the rostrum like to accuse everyone without any evidence?

Further, the Ministry of Finance complains that fines for individual entrepreneurs for failure to submit alcohol declarations amount to 10-15 thousand, and for LLCs it is already 150-200 thousand rubles. “In this regard, organizations selling beer and beer drinks, in order to evade responsibility, enter into fictitious lease agreements with individual entrepreneurs for the sale of these products,” it says explanatory note. How many such cases have been identified? Which individual entrepreneurs entered into such agreements? The Ministry of Finance is bashfully silent about this data.

I have a logical question: why did you introduce EGAIS then? Alcohol declarations duplicate this system and for good reason they should be abolished long ago! Almost all individual entrepreneurs have long ago registered with EGAIS and conscientiously submit data on alcohol turnover. What else do you need? What other data can you get from alcohol declarations that are not in the Unified State Automated Information System?

When the sale of beer in kiosks was banned on January 1, 2013, about 20% of entrepreneurs closed, and the budget lost huge amounts of tax revenue. The government realized this long ago and is now making attempts to revive the stalls. At the same time, the Ministry of Finance wants to ban the sale of beer to individual entrepreneurs from July 1, 2017, but here 90% of sellers are individual entrepreneurs. What are you missing, people's anger? Is life boring? Or are you up there unable to divide grants from large chains?

In your opinion, now I need to spend money on opening an LLC, extra bookkeeping, buying new keys for Unified State Automated Information System, cash registers, etc.? Do you think this is support for entrepreneurship? I think that sane people from the government will throw even more such questions at the Ministry of Finance. You are raising the excise tax on beer by 60% from January 1, 2017! Will you burst, gentlemen, deputies?

The Ministry of Finance and the RAR have so far refrained from commenting on such questions. This is called: they blurted out without thinking, as most often happens with us. Or is this how they test public opinion? If a wave of indignation arises, then we’ll drop the topic. And if not, we’ll quietly push it to the admiration of all the big networks that give us money in order to crush small entrepreneurs.

I consider the ban on the sale of beer to individual entrepreneurs from July 1, 2017 not only thoughtless, but downright criminal. I think those at the top still understand this and will not allow such a stupid initiative to proceed. What do you think about all this? Write in the comments. And subscribe to new articles, I will keep you up to date!

Sincerely yours, Andrey Pogudin.

We hasten to please entrepreneurs planning to open a beer store: a license is not required to sell draft and bottled beer. Only strong alcohol (above 16%) is subject to mandatory licensing. For beer and drinks based on it: cider, poire, mead, etc. this requirement does not apply.

The rules for the sale of beer are regulated by Article 18 of Federal Law No. 171-FZ. It is there that the “types of activities subject to licensing” are described.

What documents are needed to sell beer on tap: list

Many entrepreneurs open cafes where, in addition to draft beer snacks and hot dishes are served. This kind of business gives you more opportunities. A cafe with draft beer can be located near airports and train stations, near sports facilities and in other places where opening a regular outlet selling foamy beer is illegal.

However, keep in mind that the requirements for catering outlets are stricter. So, you will need a sanitary and epidemiological certificate from the SES. And to get it you need a whole package of documents:

- Certificate of registration of individual entrepreneur or LLC

- Certificate of registration with the tax service

- Approved charter of the enterprise

- Order on appointment to the position of store director

- Full list products sold

- Plan from the Bureau of Technical Inventory (BTI)

- Technical passport of the object

- Agreement for waste disposal and removal

- Contract for carrying out work on disinfection of premises

- A list of employees

- Medical records of employees who pour beer

- Hygiene certificates

- SEZ for goods sold

- Plan for carrying out and monitoring the implementation of sanitary and preventive measures

Requirements for a draft beer store in 2017: what documents will be needed during inspection

Retail outlets and public catering establishments are often subject to inspections by supervisory authorities. To be prepared for any service visit, keep on hand:

- Product quality certificate provided by the manufacturer

- Invoices for the entire range of goods

- Lease agreement or proof of ownership of premises

- Employment contracts and employee medical records

- Conclusion from the SES (for a catering point)

All trade reports are maintained in accordance with the regulations established by the Tax Service. In addition to the standard documents for any business, the owner of a beer store is required to submit alcohol declaration in form No. 12. The document is submitted to the local branch of Rosalkogolregulirovanie. The declaration can be submitted electronically. Special software will facilitate the process of filling out the declaration.

Fire requirements for a draft beer store: what to check before signing a lease

The requirements of the Fire Inspectorate do not differ from the requirements for other retail outlets. If you rent a premises, then the landlord is responsible to the fire department. Before signing a store lease agreement, make sure that the premises meet the established standards:

- Fire alarm installed

- There is an evacuation plan

- A fire safety log is maintained

Maintaining internal documentation

The owner of a draft beer store needs to keep records. The requirement applies to individual entrepreneurs and LLCs. This is reflected in Federal Law No. 164. The sales log must be completed every day. It contains sales information: product name, quantity of goods received and sold.

Beer Store Permits: Follow the Law and Run a Successful Business

By complying with the above requirements, you will be able to run a business selling draft beer and not break the law. If you want to bypass the difficult period of paperwork and get started faster, pay attention to ready business. When purchasing a beer store operating in St. Petersburg, check whether the owner has all the necessary documents.

If you are interested in offers in other cities, Altera Invest will help you. We have stores selling draft beer in Moscow. As well as a database of beer stores that are sold throughout Russia.

All manufacturers and suppliers of alcoholic beverages greeted 2016 with anxiety and doubts. The innovation called EGAIS frightened many businessmen and raised a lot of questions. What investments will be required, and will the profit be maintained?

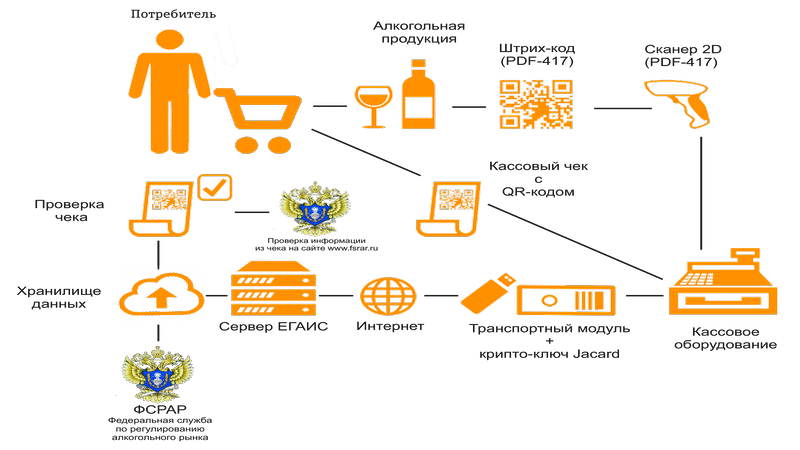

EGAIS or Unified State Automated Information System began its work in 2005, but until 2016 only large alcohol producers and importers interacted with it. She represents a kind of database, allowing you to control the production and movement of alcoholic beverages.

EGAIS or Unified State Automated Information System began its work in 2005, but until 2016 only large alcohol producers and importers interacted with it. She represents a kind of database, allowing you to control the production and movement of alcoholic beverages.

Since the beginning of 2016, the accounting rules for beer products have changed in our country. Now all organizations and individual entrepreneurs that sell even weak alcohol work with the system: beer and beer drinks, cider, mead, alcohol-containing cocktails, etc. According to Letter from FSRAR No. 17788/15-02 dated September 21, 2015, organizations engaged in retail trade in such products are required to maintain a report on receipts and purchases, but they are not yet required to record their sales.

Basic goals introduction of EGAIS into work consists of organizing:

- Control over the import and export of alcohol for the calculation of excise taxes.

- Accounting for production and sales of alcohol-containing drinks. For this purpose, the date and place of bottling, name, volume and strength of the specific product are reflected on each container and in the accompanying documentation. If this information on the container and in the documents does not match, such products are not subject to further sale.

- Tracking counterfeit products that have not passed certification, because it should not end up on store shelves or be offered to the public.

Among other things, EGAIS simplifies the work of not only regulatory authorities, but also analysts. The alcohol market is constantly controlled by the state and brings in considerable profits, so it is very important to monitor its condition. Statistical authorities that monitor the production of alcohol in the country and its consumption are also interested in this system.

Thus, EGAIS is certainly useful and convenient for the state, but it can also facilitate accounting at retail outlets for entrepreneurs themselves. Knowing exactly when and how much product was received and sold, it is much easier to control its movement, surpluses and shortages, rotation and expiration dates.

Requirements for business and its organization

Can an individual entrepreneur sell retail beer drinks? Of course, there are no prohibitions on such activities in the current legislation. However, there are some requirements for organizing such a business and equipping a retail outlet.

Can an individual entrepreneur sell retail beer drinks? Of course, there are no prohibitions on such activities in the current legislation. However, there are some requirements for organizing such a business and equipping a retail outlet.

It should be immediately recalled that the sale of strong alcohol, wines and beer products in bulk is permitted only to legal entities. Individual entrepreneurs can sell beer and beer drinks only at retail if they do not have their own farm and are not official manufacturers of products (No. 171-FZ of November 25, 1995).

A prerequisite is also availability of permanent premises(trade is prohibited in kiosks, stalls and mobile pavilions unless they are registered as catering outlets).

There is also several legal prohibitions:

- Sale of alcoholic beverages before 8:00 am and after 11:00 pm (unless more stringent restrictions are imposed by local authorities).

- Sales to minors.

- The location of the point in the vicinity of medical, educational and other cultural institutions, as well as trade in in public places: at train stations, in transport, gas stations, etc.

- Sale of similar drinks that do not have accompanying documentation (bill of lading, certificate, etc.). Alcohol-containing drinks that do not have labels or excise stamps on their containers are not subject to sale.

In addition, all individual entrepreneurs selling beer must keep a sales ledger in a unified form. The use of cash register is not mandatory for all individual entrepreneurs, but it is necessary to provide customers with BSO (strict reporting forms or sales receipts) upon request.

Among other things, points selling beer must be equipped with the necessary equipment for reporting in the Unified State Automated Information System. This nuance deserves special attention.

IN currently a point selling beer and similar drinks simply cannot operate without interaction with EGAIS. No supplier will release products to an entrepreneur who is unable to electronically confirm its receipt. So, where to start opening such a retail outlet?

- Register on the FS Rosalkoregulirovanie website egais.ru and create a personal account.

- Purchase a crypto key (JaCarta or GOST Jakarta). Specialized organizations are engaged in the production and sale of keys.

- Obtain a CEDS (qualified electronic digital signature) and apply it to the key. To do this, you should contact the Federal State Unitary Enterprise of your region with your passport, OGRN, SNILS and TIN certificates, you will also need the crypto key itself, and for each outlet. This service is paid and the signature on the key is valid for a year, after which the procedure must be repeated.

- Download UTM (universal transport module) to your computer. This can be done for free on the website of the Federal Federal Service for Regulation of Alcohol Regulation, but only after receiving the key and applying an electronic signature to it.

Only after all these manipulations will it be possible to begin receiving goods from suppliers and selling them. In general, working with EGAIS is not too complicated and is in many ways similar to the usual acceptance of paper invoices. If the equipment is installed and configured correctly, the algorithm of the actions performed is correct, then understanding the system will not be difficult.

The main issue with any innovations in the trade of alcoholic beverages has been and remains licensing. According to clause 1 of Article 18 No. 171-FZ, a license is not required for retail trade in beer (mead, cider and beer drinks), i.e. for organizations and individual entrepreneurs there is no need to purchase it.

And yet, some tightening for individual entrepreneurs selling beer will be introduced this year:

- From January 1, 2017, the production and wholesale, and from August 1, retail trade of beer bottled in containers larger than 1.5 liters, is prohibited. For such a violation of IP, a fine of 100-200 thousand will be imposed, for legal entities- from 300 to 500 thousand rubles.

- Transition to a new cash register (cash register equipment). From March 31, all organizations and individual entrepreneurs will be required to use cash register systems when making payments to the buyer (No. 261-FZ dated July 3, 2016), including catering outlets.

The last point causes a lot of controversy among entrepreneurs, because... contradicts No. 54-FZ (ed. 07/03/2017), which obliges individual entrepreneurs working under OSNO and Unified Agricultural Tax to apply the new CCP only from July 2017, and for UTII and PSN - from the same month of 2018.

The conflict of these laws is resolved by Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 47, establishing the principle of priority of special rules over the basic ones. Thus, priority belongs to No. 261-FZ, and it is its requirements that entrepreneurs will be required to obey.

Therefore, businessmen selling retail beer and similar drinks will have to spend the money saved on a license on new online cash registers and connecting to the OFD (fiscal data operator).

Features of work

So, government authorities have taken control of the movement of all alcoholic products, from the manufacturer to the end consumer. What is required from individual entrepreneurs selling beer in this case? How to interact with EGAIS and perform all operations correctly?

An approximate scheme of work looks like in the following way:

- Before sending the ordered goods to the retail outlet, the supplier fills out paper and electronic invoices, indicating them in the system itself.

- The electronic document is sent to the store's UTM. From it you can find out detailed information about each unit of goods.

- The responsible person accepts the goods in terms of quantity and quality, checking the information on the bottle and in the accompanying documents (manufacturer, volume, place and date of bottling). If there is a discrepancy, the product will not be accepted.

- When receiving the goods, the store compares all data with the electronic document in the UTM. If there are no discrepancies, the individual entrepreneur confirms this in the Unified State Automated Information System.

- After sending the notification, the quantity of goods is debited from the balance in the supplier’s database and placed on the balance of the retail outlet.

- If the goods actually received do not correspond to the documentary data (mis-grading, shortage, surplus), the individual entrepreneur has the right to refuse the product or still accept it. However, the discrepancy is necessarily recorded in the system. In this case, it is better to contact the supplier and discuss the situation. All discrepancies must be resolved within three days.

- Until the fact of receipt is confirmed in EGAIS, the products are not released for sale.

If the system works properly, then keeping records using EGAIS is quite simple.

Necessary equipment

The most painful topic for businessmen is the upcoming expenses for additional equipment. The point of sale must be provided with:

- a computer with 2 GB of RAM or higher;

- connection to the Internet;

- Windows OS 7 or higher;

- crypto key with ;

- installed UTM and software for EGAIS;

- online cash register and barcode scanner (from April 1, 2017).

If you have a new cash register, there is no need to keep a daily sales journal; in this case, it is possible to generate it electronically.

Connection

Currently, there are many organizations that will help you connect to EGAIS for a fee. Some individual entrepreneurs enter into a long-term cooperation agreement with them and pay for services monthly, inviting specialists in case of various failures and breakdowns. But you can make the connection yourself. To do this you need:

- Purchase a crypto key and a PC for a retail outlet with Internet access.

- Register on the official website of the FS RAR and create a personal account.

- Download and install UTM on your PC.

- Install a new CCP (here you will definitely need the help of specialists).

After correctly completing all the steps described above, the seller of retail beer and similar drinks will be able to enter all the information about his own purchases and sales.

One of the most frequently asked questions entrepreneurs is return of alcoholic beverages to the supplier. Previously, this manipulation was everyday and familiar, but with the advent of EGAIS, the procedure has become noticeably more complicated.

One of the most frequently asked questions entrepreneurs is return of alcoholic beverages to the supplier. Previously, this manipulation was everyday and familiar, but with the advent of EGAIS, the procedure has become noticeably more complicated.

In principle, the return invoice is created in the same way, only in UTM. The difficulty is caused by products received before 2016, which are not on the balance sheet of the retail outlet.

A return invoice is created in the EGAIS system, printed and transferred to the supplier along with the batch of returned goods. When he confirms receipt, the commodity units are written off from the point’s balances and added to the supplier’s balance sheet.

Responsibility for lack of connection

In Russia, control over the production and sale of alcoholic beverages is regulated by Federal legislation. Failure to comply with these requirements and violation of the law threatens businessmen with considerable fines:

- For the head of the individual entrepreneur - from 10,000 to 15,000 rubles.

- For companies and legal entities the numbers are: 150-200 thousand rubles.

According to experts, the implementation of EGAIS and the necessary equipment will cost retail beer sellers at least 30,000 rubles. However, numerous fines will cost those violating the law much more. Considering that without necessary equipment and connecting to the system, not a single supplier will be able to send the goods to the retail outlet, then the choice is obvious: you will still have to obey government requirements and laws.

You can learn more about the legislative framework in the beer trade from this video.

Beer belongs to the category of alcoholic beverages. This imposes a number of prohibitions and obligations on the activities of stores engaged in their sale, the list of which is determined by regulations. You cannot sell beer at night, or at any time of the day if the buyer is a minor.

Any business begins with obtaining permits

Business entities operating in the beer industry are regularly required to submit declarations indicating sales volumes. Selling alcohol is impossible without permits, so many businessmen have a question about whether a license is needed to sell beer.

IN Federal Law, which regulates the issuance of an alcohol license, there is a clause stating that a permit is required for the production and sale of alcohol-containing beverages. The exception is beer and some other low-alcohol drinks. Therefore, in light of the current legislation, you can be sure that a license to sell beer is not needed. However, there are requirements and restrictions for organizational activities prior to the sale of the drink.

Terms of sale of beer

Since beer is alcohol, its sales must be organized in such a way that the products are not available to the public anywhere and at any time.

The question of how much a beer license costs is not relevant, since this permit is only required for strong drinks, which do not include beer. Legislative restrictions consider enough prohibitions that regulate business without a license.

Restrictions on the sale of alcoholic beverages act for the benefit of society because they prevent the development of beer alcoholism. This disease can affect all categories of citizens, especially women and children. And if for sellers, selling products in large volumes means profit, then lovers of the foamy drink pay for their excessive use with their health and an incipient sense of addiction.

Where products cannot be sold

Restrictions applied when selling beer

Draft beer can be sold without a license from 8 a.m. to 11 p.m. The exception is public catering establishments. It is prohibited to sell alcoholic beverages classified as beer in the following facilities and adjacent areas:

- fuel refueling points;

- intended for sporting and cultural events;

- public transport and its stops;

- crowded places;

- military;

- educational institutions for children;

- medical institutions.

Read also: Strict reporting forms for individual entrepreneurs

Requirements for the place of sale

The place where beer is sold also has special requirements. The product can only be sold in stationary retail establishments. The store building must have a foundation. It is mandatory to include real estate in the registry database.

It is worth noting that temporary structures are not suitable for trade. If the store plans to sell strong and low-alcohol alcoholic beverages, then it should be noted that the area of the premises should be in the range from 25 to 50 square meters, depending on the location of the point of sale in the city or rural area. When selling one beer, there are no restrictions on area.

Selection of clientele

The sale of alcoholic beverages, which includes beer, is prohibited to citizens who have not reached the age of majority. If there is any doubt about the client's age, the merchant must request a document that could confirm the age.

If the seller sold products to a prohibited group of buyers, then not only the negligent seller, but also his manager will be subject to punishment. The seller will pay a fine of 50,000 rubles, and his manager in the status of an individual entrepreneur will pay a fine of 200,000 rubles. If the sales organizer is a legal entity, then the violation will cost its manager 500,000 rubles. In special cases, when the buyer’s age is clearly less than 18 years or the violation was detected again, the seller may face criminal liability.

Legislative innovations

![]()

Monitoring activities in the field of production and sales

Since the beginning of 2017, it has been prohibited to pour drinks into plastic containers in production. The draft includes a ban on the wholesale and retail sale of products bottled in plastic containers whose volume exceeds 1.5 liters.

In case of violation of legal requirements, individual entrepreneurs should be prepared to pay a fine in the amount of 100,000 to 200,000 rubles. For legal entities, the fine corresponds to 300,000-500,000 rubles.

Control over product sales

Control circuit The production and circulation of alcohol is controlled public service EGAIS.