How to increase the net profit of an enterprise. Ways to increase profits and profitability of an enterprise

Instructions

In a manufacturing enterprise, as a rule, one of the strategies is chosen - either increasing profits or reducing costs. Each strategy requires a certain investment of labor, capital and time, so not every enterprise can go in two directions at once. Choose what is simpler and cheaper. Typically, a manufacturing enterprise does not engage in sales itself, but sells goods to wholesale buyers. Building a network of its own stores, hiring and training sales personnel is not profitable for an enterprise - no trade markup will justify the costs incurred in selling a single product produced by the plant. Increasing the volume of output is also costly - it is necessary to purchase additional equipment, build new workshops, etc. Therefore most often production organizations are on the path to cutting costs. Modernize equipment, reduce staff, non-production costs, payments utilities, looking for cheaper raw materials and components, optimizing. In the worst case scenario, workers' wages are cut.

Profit any companies It is very simple to calculate - subtracting expenses from income. There are two standard ways to increase profits: increasing revenues and reducing costs. However, everything works out smoothly only on paper. What specific steps need to be taken to increase profits?

Instructions

Develop a strategy that takes into account all promising directions in the development of your companies, its current place in the market and the importance of marketing moves for profit growth.

Optimize production so that cost final product. To do this, enter into agreements with new suppliers of raw materials or wholesalers, focusing on more low level prices, re-equip the enterprise, introduce new production methods, conduct certification of employees in order to identify the level of professional suitability. If necessary, fire employees who are not performing to the required level. Coordinate your actions in

The financial stability of the company, competitiveness, and investment attractiveness are influenced by net profit. This is the result of the enterprise’s work, formed after deducting all costs and taxes. During the crisis years, many enterprises faced a decrease in income and sales. To overcome such a situation and stay afloat, the company must use ways to increase profits.

Let's look at how to increase the profitability of an enterprise by 100%.

What is profit

There are several formulas for calculating this financial indicator:

- Revenue – Product cost – Expenses (production, general, other) – Taxes.

- Financial profit + Gross + Operating – Taxes.

- Profit before tax - Taxes.

Different ways of expression, but the essence is the same.

Let's calculate the net profit on the balance sheet using an Excel spreadsheet:

The numbers are conditional. This calculation allows you to see what determinants influence the formation of profit.

To obtain net profit, you need to find profit before taxes, marginal and operating.

How are these indicators related:

- Gross (margin) illustrates sales performance.

- Sales profit (operating) shows how productive the main activity is (production efficiency, for example).

- Profit before tax is net of other income and expenses from auxiliary activities.

Thus, net profit is an indicator of the operating efficiency of an enterprise, free of all costs and expenses.

How to increase the profitability of an enterprise by 100%

Essentially, the profitability of an investment is influenced by three determinants: the cost of the product, sales volume and costs (fixed and variable). Let's look at how to increase the profitability of a company by influencing one of these factors.

Let's use a simpler table:

The products sold are profitable. The business margin is 10%.

How should each factor be changed to increase profits by 100% (while maintaining other conditions):

The leverage effect will be only three. Although it is quite difficult to reduce fixed costs. You can save on overhead costs (business trips, employee training; eliminate losses from downtime, etc.).

Let's try to increase sales by 10%.

Profit increased by only 29% (compare with a 100% increase in profit for a 10% increase in price). The leverage effect is three.

To overcome the crisis, the company needs to use all methods to increase profits. Let's look at one more example.

Recall that profit consists of turnover multiplied by margin (formula above). Turnover is the product of three elements: the number of customers, the number of purchases (how many times customers make a purchase in a certain period) and the amount of the average check. Let’s expand the formula further: the number of customers is the number of potential buyers (leads) multiplied by the customer conversion rate.

Potential buyers are people who have shown interest in the product (went to the store, called an ad, looked at the Internet page). Buyer conversion allows you to find out how many potential buyers became real (made a purchase).

So we came to the detailed profit formula that was indicated at the beginning of the article:

(Number of leads * Lead conversion) * Average bill * Number of purchases * Business margin.

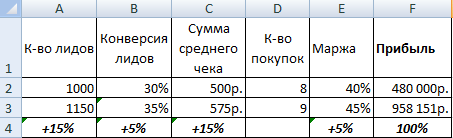

Let's calculate the company's profit for the previous period:

How to optimize these factors to increase the profitability of the enterprise by 100%:

We increased the number of potential buyers by only 15%. Customer conversion – by 5%. Average check amount – by 15%. Marginality – by 5%. As a result, profit will increase by 100%.

Thus, by influencing only one of the factors, it is difficult to achieve the necessary improvements. Price has the greatest impact on investment profit, sales volume has the least impact. A drop in sales will not have as critical an impact on profits as a drop in prices. It is important to avoid a simultaneous decrease in these two indicators by any means.

Variable and fixed costs (together) affect net revenue almost as much as price. Therefore, the best way to increase profits is to optimize costs and prices.

Ministry of General and vocational education RF

Department of Economics and Management

Essay

“How to increase enterprise profits

( enterprise profit analysis)"

Completed by: student of group RTS-97

Aslamov D.A.

Checked: Shurko O.V.

Introduction………………………………………………………….…………3

The concept of profit and its functions……………………………………..4

Concept of profitability

trading enterprise…………………………………………………………….5

The role of profit in the formation of fi-

financial resources of the enterprise……………………………………….5

Factors influencing profit…………………………………….8

Factors influencing profit (table)….………………….……10

Ways to increase profits

at the enterprise………………………………………………………...11

Afterword………………………………………………………....12

Introduction.

Currently, in a market economy, more and more trading enterprises are appearing. Every company strives to make as much profit as possible at minimal cost. To ensure the profitability of his business, an entrepreneur should deeply analyze the current situation on the market, as well as within his enterprise. Achievement main goal- maximizing profits is possible only with correct and thoughtful planning of the activities of a trading enterprise. My abstract highlights two main performance indicators trading activities enterprises: profit and profitability. The first of them, strictly speaking, is the goal of the enterprise, the second indicator - the profitability indicator - allows you to accurately assess the level of development of a trading enterprise both as a whole and from various aspects.

Russia's gradual transition from a centrally planned economic system to a market one raises the question of methods of running an enterprise's economy in a new way. Traditional structures and ways of life change. Under these conditions, enterprise management, studying and forming what is called civilized forms of market relations, become a kind of “architects” of the development of new methods of running the enterprise’s economy.

In a market economy, a special place is given to the entrepreneur who is capable of performing an extremely important function in the enterprise - “earning profit”

The functioning of an enterprise in market conditions involves the search and development by each of them own path development. In other words, in order not only to survive, but also to develop in the market, an enterprise must improve the state of its economy: always have an optimal ratio between costs and production results; find new forms of capital investment, find new, more effective ways to bring products to the buyer, pursue appropriate product policies, etc.

Each enterprise independently makes decisions regarding what, how much and how to produce goods (provide services), where and how to sell them and, finally, how to distribute the income received (compensation funds, wages, savings). On all these issues, it makes decisions in accordance with its interests, answering with its property for mistakes or incorrectly chosen actions

The concept of profit and its functions.

Profit is the most important category of a market economy.

There are several interpretations of the concept of profit. For example, K. Marx in “Capital” defined profit as a modified surplus value that obscures its essence. The author of Capital believed that the source of surplus value was exploitation, the unpaid surplus labor of hired workers. According to Marx, this is an external form of manifestation of the essence of the bourgeois economic system, bourgeois production relations. Thus, exploitation is the main thing that lies at the very basis of the Marxist interpretation of profit.

Modern economic thought views profit as income from the use of factors of production, i.e. labor, land and capital. Denying profit as a result of exploitation and appropriation of unpaid hired labor, we can distinguish the following definitions of profit. Firstly, profit is payment for business services. Secondly, profit is the payment for innovation, for talent in managing a company. Thirdly, profit is a payment for risk, for the uncertainty of the results of entrepreneurial activity. Risk may be associated with the choice of one or another managerial, scientific, technical or social solution, with one or another variant of natural and climatic conditions. The risk may also be associated with unpredictable circumstances - natural disasters, interethnic and interstate conflicts, etc. The results of risk can be radically different - a large profit and, conversely, its decrease or even the ruin of the company. Fourthly, this is the so-called monopoly profit. It arises when the manufacturer has a monopoly position in the market or when there is a natural monopoly. Monopoly profits are largely unsustainable.

In a market economy, profit is understood as remuneration for the use of a specific factor of production - entrepreneurship. Entrepreneurship is a specific factor, since, unlike capital and land, it is intangible and does not appear in material form. Therefore, from these positions it is quite difficult to quantify the profit received by the enterprise.

In microeconomics, the concept of profit is defined as a value defined as the difference between total revenue and total costs, the difference between income and expenses.

Being the most important economic category and the main goal of any commercial organization, profit reflects the net income created in the sphere of material production and performs a number of functions.

Firstly, profit characterizes the economic effect obtained as a result of the enterprise’s activities. Making a profit in an enterprise means that the income received exceeds all expenses associated with its activities.

Secondly, profit has a stimulating function. This is due to the fact that profit is at the same time not only a financial result, but also the main element of the financial resources of an enterprise. Therefore, the enterprise is interested in obtaining maximum profit, since this is the basis for expanding production activities, scientific, technical and social development enterprises.

Thirdly, profit is one of the most important sources for the formation of budgets at various levels.

The concept of profitability of a trading enterprise.

In a market economy, the performance of a trading enterprise is assessed by a system of indicators, the main one of which is profitability. Profitability is defined as the ratio of profit to one of the indicators of the functioning of a trading enterprise. When calculating profitability, it is used various indicators arrived. Profitability indicators make it possible to identify not only the overall efficiency of a trading enterprise, but also to evaluate different sides his activities.

The role of profit in the formation of financial resources

enterprises.

In an enterprise, profit is generated as a result of sales of products. Its value is determined by the difference between the income received from the sale of products and the costs of its production and sale. The total amount of profit received depends, on the one hand, on the volume of sales and the level of prices set for products, and on the other hand, on how well the level of production costs corresponds to socially necessary costs.

At the same time, profit at an enterprise depends not only on the sale of products, but also on other types of activities that either increase or decrease it. Therefore, in theory and in practice, the so-called “balance sheet profit” is distinguished. Its name speaks for itself. It consists of profit from sales of products (revenue from sales of products without indirect taxes minus costs of production and sales of products) plus non-operating income (income from securities, from equity participation in the activities of other enterprises, from leasing property, etc.) minus non-operating expenses (costs for production that did not produce products, for the maintenance of mothballed production facilities, losses from writing off debts, etc.)

In addition, gross profit is distinguished, which represents balance sheet profit minus or plus the financial result from transactions with fixed assets, intangible assets and other property.

Thus, book profit ( P b) can be determined by the formula:

P b = + P r + P i + P v.o. ,

Etc– profit (loss) from sales of products, performance of work and provision of services,

P and– profit (loss) from the sale of enterprise property,

P v.o.

– income (losses) from non-operating operations.

As a rule, the main element of balance sheet profit is profit from the sale of products, performance of work or provision of services. Profit from product sales depends on internal and external factors. Internal factors include: acceleration of scientific and technical progress, level of management, competence of management and managers, competitiveness of products, level of organization of production and labor, etc. external factors

, which do not depend on the activities of the enterprise, include: market conditions, price levels for consumed material and technical resources, depreciation rates, taxation system, etc. Receiving a stable income is the main purpose of business. Systematic analysis profitability and profitability indicators contributes to efficient work enterprises. Depending on the specifics of the company, the business owner applies proven ways to increase profits . These include both time-tested technologies and innovative techniques

increasing efficiency.

What is profit and profitability of an enterprise The numerical values of profit and profitability ratio are the main, objective assessment of the efficiency of the enterprise. Net profit is calculated as the difference between gross income and production costs. Profitability is numerically equal percentage

between costs and profits.

The main ways to increase profits in an enterprise

- There are two basic methods for increasing profitability and profitability indicators:

- reduction of production costs;

increase in sales.

Depending on the specialization of the enterprise, the business owner chooses one of the ways to increase net profit. The simultaneous introduction of technologies aimed at both reducing costs and increasing sales leads to reverse effect

Owners of factories and production facilities are advised to opt for reducing production costs. In the case when the company does not control the sales of products independently, but sells them through an intermediary, measures to increase the number of sales will not justify the funds invested in them.

Firms whose specialty is based on the trade of finished goods or services resort to technology to increase sales volumes. In their case, it is not advisable to reduce costs: such tactics will lead to a sharp decrease in quality, which will negatively affect consumer loyalty.

Each of the two main ways to increase profits at an enterprise includes a set of measures aimed at optimizing business processes within the company. Based on them, the business owner draws up his own plan for reorganizing production in order to increase profitability.

The technology for increasing the profitability of a company is formed based on an analysis of the existing business model, market characteristics and preferences of the company owner. In industrial practice there are five basic techniques, contributing to increasing the efficiency of the company:

The technology for increasing the profitability of a company is formed based on an analysis of the existing business model, market characteristics and preferences of the company owner. In industrial practice there are five basic techniques, contributing to increasing the efficiency of the company:

- Increasing the number of potential consumers.

To this end, they are modernizing the advertising campaign, strengthening the marketing department, and increasing the popularity of goods and services in the market. As the number of potential consumers increases, the number of actual transactions will also increase. - Increasing the number of real clients.

An advertising campaign should not only introduce customers to the product, but also interest them and motivate them to purchase. This can be done through unique offers, low pricing or profitable promotions. - Making changes to the quality of service.

The value of a customer for a company increases significantly at the moment when he moves from a one-time customer to the category of regular ones. In order for consumers to use the company’s services again, it is recommended to improve the quality of service, develop special offers and a loyalty policy for regular customers. - Increasing profitability due to increasing prices and introducing additional sales technology.

You can increase gross profit not only due to sales volumes, but also due to the price of the product or service. An increase in sales volume is facilitated by the method of selling additional goods together with making a large purchase. An example of such a way to increase net profit is the sale of accessories when purchasing a laptop or mobile phone. - Reduced production costs.

Switching to cooperation with a supplier at more favorable prices, moving to a building with less rent or concluding a contract for wholesale supplies at a low price helps reduce costs, but does not affect the quality of the product.

The listed methods are implemented both individually and comprehensively, forming your own plan for increasing profitability. These methods do not have a global impact on enterprise management technology, its structure and production processes.

Business automation to increase profits

If a company owner is ready for large-scale changes, it is worth thinking about automating business processes. This procedure requires the allocation of an additional budget and the involvement of IT specialists. As a result, labor efficiency increases and the company's competitiveness increases.

The return must be proportional to the investment and the risk.

David Hume (1711–1776), English philosopher

The automation process is divided into three stages:

- audit of the existing business model;

- detection of shortcomings and weaknesses;

- formation of the desired business model.

As a result of the implementation of the generated proposals, the business owner will have the opportunity to bring the company to a completely new level. Beneficial use modern technologies will simultaneously reduce production costs and increase sales by increasing employee productivity

I will be happy to answer all questions in the comments to the article.

Many people who run their own business dream of increasing profits, regardless of whether it is a large enterprise or a small workshop.

If a person becomes a businessman, then he takes this step consciously. But it’s worth remembering that it’s not enough to just be listed as an entrepreneur; you need to do something else to grow your business and profits. Therefore, many companies have a question: how to increase business profits? There are three main ways to do this.

3. Cost reduction

To be able to manage your business, you need control. Therefore, the main challenge is to find ways to transform your work. This will allow it to be completed faster and at lower costs. It is also necessary to analyze each of these types of costs for their further reduction or even complete removal. All programs to reduce them must include work on collecting receivables and timely payment wages employees, suppliers of raw materials for the materials provided.

To be able to manage your business, you need control. Therefore, the main challenge is to find ways to transform your work. This will allow it to be completed faster and at lower costs. It is also necessary to analyze each of these types of costs for their further reduction or even complete removal. All programs to reduce them must include work on collecting receivables and timely payment wages employees, suppliers of raw materials for the materials provided.

2. Price increase

Most domestic companies use this method, since it is the simplest. It does not require any additional costs. But such a technique may not always be justified and effective. An unreasonable or very large increase in the cost of products can contribute to a sharp decline in sales, which will entail a decrease in profits. You can raise or lower prices for your goods provided they are competitive and there is a sufficient level of demand. Also, mandatory research of market conditions should be carried out and the degree of risk should be assessed. Otherwise, you will simply lose your regular and potential customers and your money.

Most domestic companies use this method, since it is the simplest. It does not require any additional costs. But such a technique may not always be justified and effective. An unreasonable or very large increase in the cost of products can contribute to a sharp decline in sales, which will entail a decrease in profits. You can raise or lower prices for your goods provided they are competitive and there is a sufficient level of demand. Also, mandatory research of market conditions should be carried out and the degree of risk should be assessed. Otherwise, you will simply lose your regular and potential customers and your money.

1. Increase in sales volumes

The most effective way, to increase the profit of the enterprise is participation in exhibitions. After all, this is where a company can successfully provide its new products to the target audience, improve its image, and make the brand recognizable and popular. Exhibitions are currently held daily and in large quantities. They bring together buyers and sellers in one place. Thanks to a properly prepared, organized and conducted exhibition event, a company can enter into mutually beneficial agreements, find new distributors, business partners and clients. All this will undoubtedly lead to an increase in sales and profits of the enterprise.

The most effective way, to increase the profit of the enterprise is participation in exhibitions. After all, this is where a company can successfully provide its new products to the target audience, improve its image, and make the brand recognizable and popular. Exhibitions are currently held daily and in large quantities. They bring together buyers and sellers in one place. Thanks to a properly prepared, organized and conducted exhibition event, a company can enter into mutually beneficial agreements, find new distributors, business partners and clients. All this will undoubtedly lead to an increase in sales and profits of the enterprise.

The most ideal place to increase a company's profit is exhibitions at the Expocentre Fairgrounds. The exhibition complex enjoys enormous popularity and hosts about 100 thousand exhibitions a year. Leading experts from all over Russia and Europe come here to demonstrate their products, innovative and technological innovations, and much more. If you don’t yet know how to increase your company’s profits, then Expocentre Fairgrounds will help you with this.

Each entrepreneur chooses different ways to increase the profitability of the company. In most cases, reducing costs or increasing sales is used. That is, gross profit. Nowadays, it is very difficult to reduce the cost of products without losing their quality, since suppliers usually increase prices for their services, which also entails an increase in transportation costs. In order to solve the problem of insufficient profit of the enterprise, it is necessary to implement all options: increase prices for goods, reduce costs and increase sales volumes. If all this is done correctly, you can increase your sales income several times.