Foros loan from Sberbank conditions. Sberbank - loans to individuals

When deciding to take out a loan, many borrowers first consider Sberbank’s offers. This is natural: there are favorable rates and convenient service conditions. In this article we will tell you what types of loans there are for individuals in Sberbank, what are their advantages and limitations.

Requirements for borrowers

Sberbank, like all commercial financial institutions, is interested in relationships with solvent clients. At the stage of accepting applications, bank specialists evaluate the borrower’s rating, preventing the risks of non-repayment and delays.

So, who will be approved for a loan application at Sberbank?

The main requirements for borrowers are:

- Citizens of the Russian Federation aged 21 to 75 years at the time of loan repayment;

- Having a permanent employment relationship and proven income. The family's income should be enough to pay for everyday needs and service the loan;

- Positive credit rating, no lawsuits.

Here are the bank's standard requirements, but borrowers' applications are considered individually. Therefore, in each specific lending case there may be certain conditions relating to securing the loan, attracting co-borrowers or guarantors, providing additional certificates or guarantees.

Credit products

The bank offers a range of loan products that meet the various needs of clients. Here you can get a credit card, apply for a mortgage, or take out money for a consumer loan. Let's take a closer look at the types of loans for individuals at Sberbank and the conditions in force in 2017.

Consumer loans

The most popular type of lending among the population is. This term refers to non-targeted cash loans. Depending on the amount, term and other parameters, the bank issues money with or without collateral.

Here are the main conditions for consumer loans from Sberbank in 2017:

- No collateral. Money is issued for any purpose; no deposit or report on the amounts spent is required. Under the terms of this loan, you can receive an amount of up to 3 million rubles for a period of up to 5 years. The minimum tariff will be 14.9% per annum; there are benefits for salary card holders. To approve the application, the borrower must provide proof of his income and a complete package of documents;

- Under the guarantee of individuals. For this type of loan, bank clients can borrow 5 million rubles for 5 years at an interest rate of 13.9% per annum. To obtain a loan, a guarantee from one or two persons with a permanent confirmed income is required. Salary card holders can submit only two documents to the bank for consideration of the application. The loan is issued in cash or by transfer to a card. Repayment is made in equal installments;

- Non-targeted loan secured by real estate. This type of loan makes it possible to get a large sum for a long time. According to the terms, the maximum loan size will be 10 million rubles. The limit on the amount will be the value of the collateral property: a loan is issued in the amount of up to 60% of the price of the property. The period for using money is up to 20 years. Any object owned by the borrower can be provided as collateral: an apartment, a house, a garage, a summer house or a plot of land. The borrower's spouse acts as a co-borrower if his or her income was taken into account to determine the maximum loan amount. Collateral property is subject to compulsory insurance. Life and health insurance of the borrower is carried out on a voluntary basis. Restrictions: this type of loan is not issued individual entrepreneurs, business owners, members of peasant farms;

- Loan to military personnel - NIS participants. The bank’s special offer for military personnel participating in the NIS and who are mortgage borrowers of Sberbank: a consumer loan for a period of up to 5 years. There are two options to choose from: a loan without collateral in the amount of 500,000 rubles or with the involvement of guarantors in the amount of 1,000,000 rubles. The tariff will be 13.5% for a secured loan or 14.5% for an unsecured loan. Money is provided for any purpose. As a rule, borrowers use them for additional payment for purchased housing, or for repairs and equipment new apartment. The bank does not require a report on the expenditure of the amount;

- Loan to owners of personal subsidiary plots. Persons working on private farms can receive up to 1.5 million rubles at a rate of 17.0% per annum for a period of up to 5 years. Mandatory conditions: the borrower must be the owner (owner) of the subsidiary farm and provide a guarantee from individuals. In addition to the application, passport and income certificate, you need to submit to the bank an extract from the book on subsidiary farming.

Mortgage

Mortgage loans are issued against real estate. Sberbank offers several mortgage options, both for the purchase and construction of housing. Let's look at what conditions apply in 2017:

- New buildings. The bank's partners are large development companies, and it is not surprising that they have the most favorable mortgage offers for apartments in new buildings. The loan can be issued for a period of up to 30 years, at an interest rate of 10.9% per annum. A down payment of 20% of the purchase amount is required. In addition to the standard offer, there are promotions from developers with tariffs starting from 8.9% per annum. A prerequisite is insurance of the purchased apartment;

- Ready housing. Loans for the purchase of secondary housing in Sberbank today can be issued for up to 30 years, with 20% of your own funds for the down payment. The minimum loan size will be 300 thousand rubles, the base rate is 11.25% per annum. Interest may be higher if the borrower does not have a bank salary card and a life and health insurance policy;

- Military mortgage. Sberbank provides loans to military personnel for the purchase of finished and under construction housing within the framework of the state program. The loan amount is 2.22 million rubles, at an interest rate of 10.9% per annum. The maximum loan term is 20 years, but in each specific case it is set individually and cannot exceed the borrower’s 45th birthday;

- Mortgage with maternity capital. It is worth noting that almost all mortgage loans from Sberbank can be issued using a mother’s certificate. This right is often used by families with two or more children when solving their housing problem. The program is available to all categories of borrowers, including state employees, military personnel, and young families. Standard loan terms: down payment from 20% of the property value, rates from 13% per annum, period up to 30 years. Special requirements: the purchased property must be registered as common shared ownership of all family members;

- Country house. Few banks today lend to projects for the construction and acquisition of country houses. At Sberbank you can apply for such a loan, receive targeted money for the construction or purchase of a summer house, or the acquisition of ownership of a land plot. The first payment will be 25% of the amount, the rate is 11.75%, minimum size loans of 300 thousand rubles. It is allowed to attract three co-borrowers in order to increase the loan amount. Spouses of borrowers act as co-borrowers in mandatory, regardless of age;

- Credit cards. Sberbank credit cards deserve special attention. In addition to ease of use and simplicity of design, their advantage for customers is excellent service and support. Sberbank offers cardholders the best mobile applications and Internet banking. You can use your card account from anywhere, without time restrictions. The line of credit cards includes classic and premium options. Credit limits are set for each client individually, the maximum amount can be 3 million rubles. Tariffs range from 21.9% per annum. To obtain a card, simply submit an application to a bank branch. The bank will issue salary cards to owners promptly, using two documents. The list of credit cards is presented on the website.

Refinancing

When discussing types of loans at Sberbank, one cannot ignore the topic of refinancing. This tool should be used in a number of cases, for example, to reduce the monthly installment or the convenience of servicing several loans.

The bank offers refinancing of loans received from third-party banks: you can take out up to 3 million rubles at 13.9% per annum, without collateral. Many borrowers will benefit by repaying more than expensive loans and transferring your loan portfolio to one bank.

You can also refinance mortgage loans: in 2017, Sberbank offers such a service, issuing money for up to 30 years with a base rate of 10.9% per annum. This lending option is collateral and requires insurance of the property.

Credit is a financial instrument, and you need to use it skillfully. Types of Sberbank loans satisfy any purpose and are available to borrowers with a stable credit rating. We recommend choosing loans based on your goals and assessing your financial situation for the future. After all, in addition to the benefits from purchases, you can also receive losses if you do not repay the loan on time.

There is hardly a single adult who has never visited a Sberbank office. After all, in the list of its services you can find all banking products without exception. This article will tell you about current offers in the field of lending.

Types and conditions for issuing loans at Sberbank

Sberbank: consumer loans to individuals

|

|||

|

from 15 thousand rubles (regions) / 45 thousand rubles (Moscow) up to 1.5 million rubles |

17.5 - 23.5 for clients with salary cards and pensioners receiving pensions from Sberbank 22.5 - 29.5 for other clients |

from 3 to 60 months. |

| from 15 thousand rubles (regions) / 45 thousand rubles (Moscow) up to 3 million rubles | 16.5 - 22.5 for clients with salary cards and pensioners receiving pensions from Sberbank 21.5 - 28.5 for other clients |

from 3 to 60 months. | |

|

from 500 thousand rubles up to 10 million rubles | 15,5 - 16,25 | up to 20 years |

| from 15 thousand rubles (regions) / 45,000 rub. (Moscow) up to 500,000 rub. (without guarantee) / 1 million rub. (with guarantee) | 19.5 without guarantee 18.5 with guarantee |

from 3 to 60 months. | |

|

from 15 thousand rubles up to 700 thousand rubles |

24,5 | from 3 to 60 months. |

Sberbank: mortgage loans to individuals

Name of the loan program |

||||

| from 300 thousand rubles up to 80% of the real estate price |

from 13 – special offer for Young families from 13.5 - with proof of income from 14 - without proof of income |

up to 30 years old | from 20% (15% promotion for Young families) | |

|

from 300 thousand rubles up to 80% of the real estate price |

from 11.09 – according to the program with the state. support from 13.5 with proof of income from 14 without proof of income |

up to 30 years old | from 20% |

| from 300 thousand rubles up to 70% of the real estate price |

from 14 | up to 30 years old | from 30% | |

| from 300 thousand rubles up to 70% of the cost of the building |

from 13.5 | up to 30 years old | from 30% | |

|

up to 1.9 million rubles up to 80% of the amount of real estate |

12,5 | up to 15 years | - |

|

up to 1.9 million rubles up to 80% of the amount of real estate |

12,5 | up to 15 years | - |

Sberbank loans to individuals holding salary cards

For clients receiving wages on the cards, Sberbank is ready to make the following concessions:

- Reduce the interest rate compared to third-party clients.

- Simplify the procedure for applying for a loan by not requiring a certificate of income.

- To shorten as much as possible the period for making a decision on the possibility of lending.

- Issue a loan at any Sberbank office, and not just in the city where registration is registered.

- Review the loan application sent through Sberbank Online.

Individual pensioners can take advantage of these same benefits to apply for a loan from Sberbank.

Documents for a loan from Sberbank to individuals

Documents required to obtain a consumer loan

|

|

|

|

Loan to individuals running private household plots |

|

| Borrower application form | + | + | + | + | + |

Borrower's passport |

+ | + | + | + | + |

| Income proof | + | + | + | + | + |

| Pledge documents | + | + | |||

Extract from the household ledger on the accounting of private household plots | + |

Documents required to obtain a mortgage loan

|

|

||

| + | + | + | |

| + | ||

| + | + | + | |

| +/– | +/– | +/– |

| + | ||

| |||

| |||

| |||

| + | + | + |

Documents confirming the presence of a down payment | + | + | |

| + |

Sberbank loans to individuals: interest rates

For each loan, basic interest rates, which may vary depending on various factors:

- Loan term - for a term of more than 3 years plus 1%.

- Borrower status - for third-party clients the rate is 5% higher.

2. When applying for a loan secured by real estate, the rate will depend on:

- Loan term - when applying for a loan for more than 10 years plus 0.5%.

- The ratio of the loan amount to the estimated value of the collateral. If it is more than 40%, the rate increases by 0.25%.

In addition, add one point at a time if you do not receive wages through Sberbank and refuse life and health insurance.

3. When applying for a loan to build a house or cottage, be prepared for the fact that the rate will be higher if:

- Loan term over 10 years – 0.25% for each decade.

- Down payment less than 50% - 0.25%.

- You do not receive wages at Sberbank - by 0.5%.

- You refused to insure your life - by 1%.

- The mortgage has not yet been registered - by 1%.

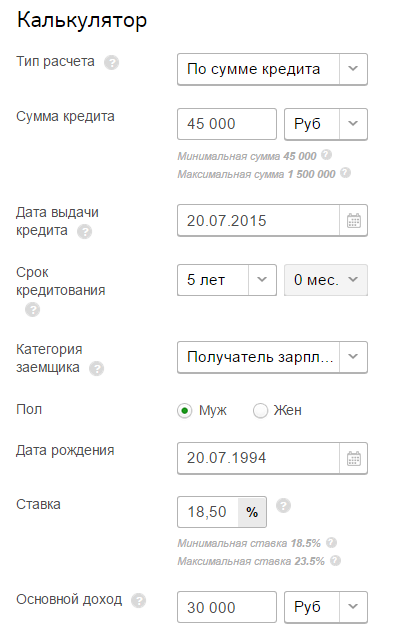

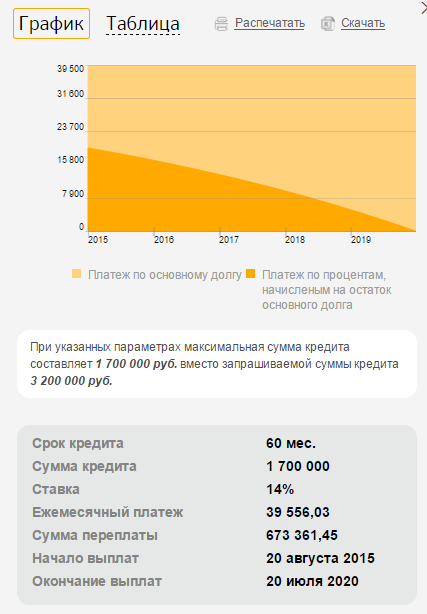

For consumer loans it looks like this:

.

To make a calculation, set the parameters of the requested loan. In this case, you can choose on the basis of which the calculation will be made:

- by loan amount;

- according to the borrower's average monthly income;

- according to the monthly payment amount.

After filling out all the lines of the calculator, preliminary loan parameters and a repayment schedule will appear.

The mortgage calculator is similar to the previous one, only fields for entering data essential for calculating housing loans have been added: the amount of the down payment, the price of the property, etc.

Sberbank: online loans to individuals

Apply for a loan online if:

- you receive your salary or pension into an account opened with Sberbank;

- you have connected the Sberbank Online service.

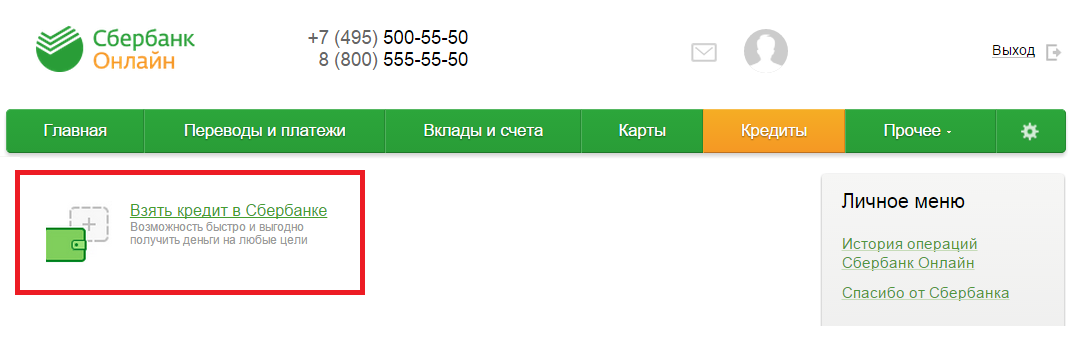

1. In the “Loans” tab of the main menu, select “Take a loan from Sberbank”.

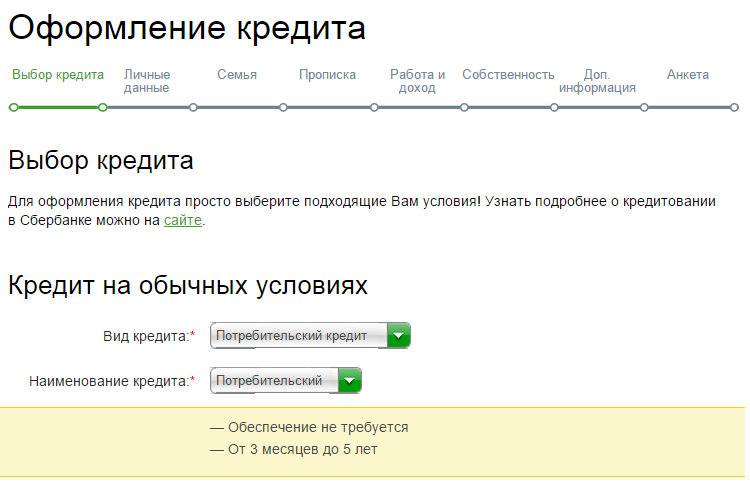

2. Set the type of loan, desired amount and term.

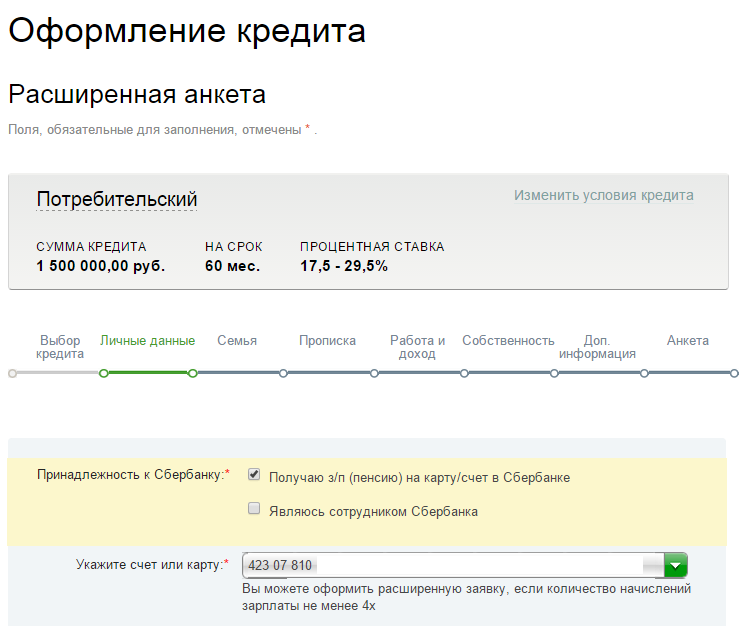

3. Fill out the personal information page. Here, indicate the account number to which you receive your salary/pension.

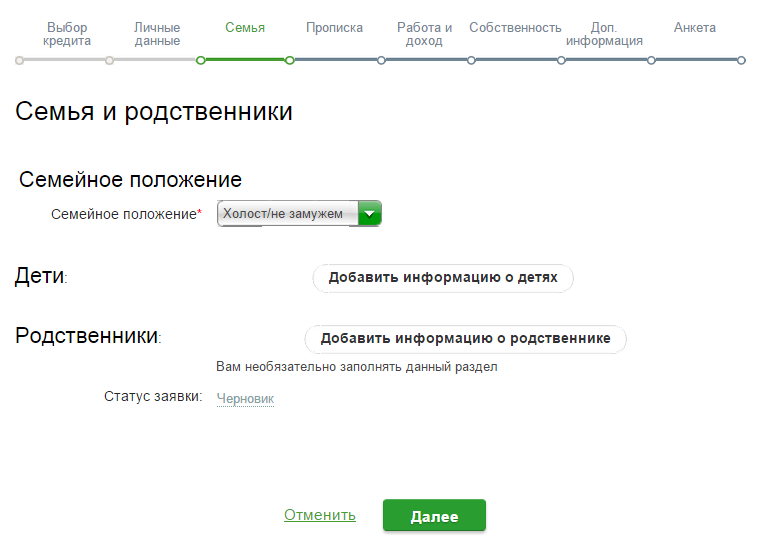

4. In the “Family” tab, enter information about your marital status, children and other relatives.

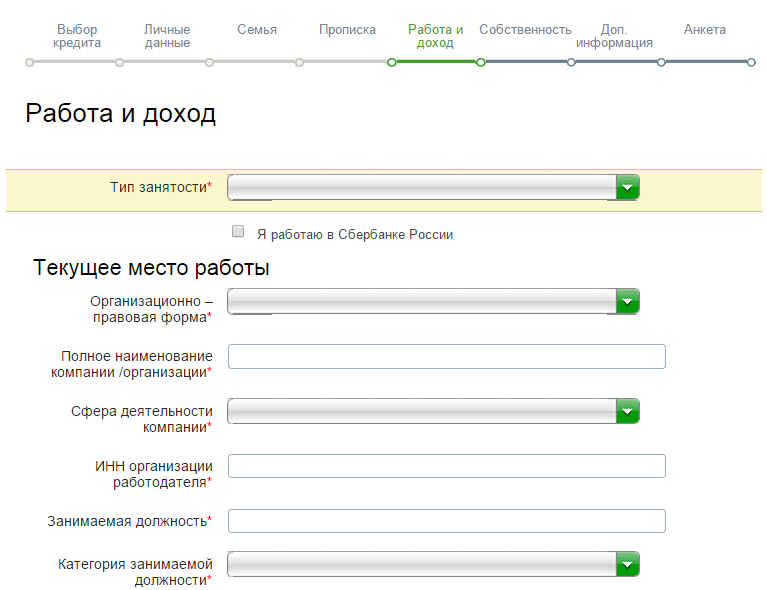

6. The next step is to fill in information about your place of work and income received.

7. If you own real estate or a car, please indicate this in the application.